How to Apply for a PAN Card for a Minor – A Step-by-Step Guide

Introduction : Applying for a PAN card is a significant step in managing financial transactions in India. Even minors, who are not yet earning, may require a PAN card for various reasons, such as being a nominee in investments or for tax-saving purposes. Here, we'll guide you through the process of applying for a PAN card for a minor.

Why a Minor Needs a PAN Card A PAN (Permanent Account Number) card is essential for various financial activities. While minors do not have taxable income, a PAN card may be necessary if they are involved in financial transactions, such as:

- Being a beneficiary of investments

- Opening a bank account

- Inheritance of property or money

- Creating a Fixed Deposit (FD) in their name

Steps to Apply for a Minor’s PAN Card

-

Download and Fill the PAN Card Minor Application Form

- Visit the official website of NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology and Services Limited).

- Download Form 49A, which is used for applying for a PAN card in India.

- The form requires the applicant's details. Since the applicant is a minor, a representative assessee (typically a parent or guardian) will need to fill in the details on behalf of the minor.

-

Provide the Necessary Documents

- Proof of Identity (POI): Aadhar card, birth certificate, or passport can be used as proof of identity for the minor.

- Proof of Address (POA): This can be the Aadhaar card, passport, or ration card of the minor.

- Proof of Date of Birth (DOB): A birth certificate, Aadhaar card, or passport of the minor.

- Representative Assessee’s Documents: The parent or guardian's PAN card copy is also required.

-

Affix Photographs

- The application form requires two recent passport-sized photographs of the minor. The minor’s photograph will appear on the PAN card, and the parent/guardian will sign across the photograph in the designated space.

-

Signature

- As the minor cannot legally sign, the parent or guardian (representative assessee) will need to sign the form. The signature should be provided in the appropriate places on the form, including across the minor’s photograph and in the designated box.

-

Submit the Application

- After filling out the form and attaching the required documents, the form can be submitted online through the NSDL or UTIITSL website. Alternatively, you can visit a PAN card center to submit the form physically.

-

Track the Application Status

- Once submitted, the application status can be tracked online through the acknowledgment number provided after submission.

-

Receive the PAN Card

- After verification, the PAN card will be issued and delivered to the address provided in the application form. The entire process usually takes around 15-20 business days.

Important Points to Remember

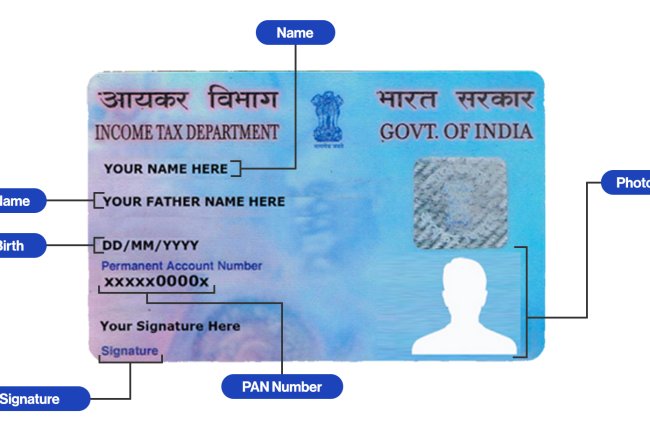

- The PAN card issued for a minor will not have their signature on it. Once the minor turns 18, they must apply for a PAN card update to include their signature.

- The PAN card for a minor remains valid for a lifetime, so there is no need for renewal, only updates in case of changes.

Conclusion Applying for a PAN card for a minor is a straightforward process that requires careful attention to details in the application form and submission of the necessary documents. Whether you’re applying for tax benefits or safeguarding the minor’s future financial transactions, having a PAN card for your child is a wise decision. Follow the steps outlined above to ensure a smooth application process.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?