All You Need to Know About PAN Number

Introduction : In India, the Permanent Account Number, commonly known as PAN, is an essential identification tool for individuals and entities. Whether you're a taxpayer, a business owner, or simply someone engaging in financial transactions, understanding what a PAN number is and its importance is crucial. This article provides a comprehensive guide to help you understand everything you need to know about PAN.

What is a PAN Number?

PAN stands for Permanent Account Number. It is a unique 10-digit alphanumeric identifier issued by the Income Tax Department of India. Each PAN is unique to the individual or entity it is assigned to, and it remains unchanged throughout their lifetime, regardless of any changes in personal details.

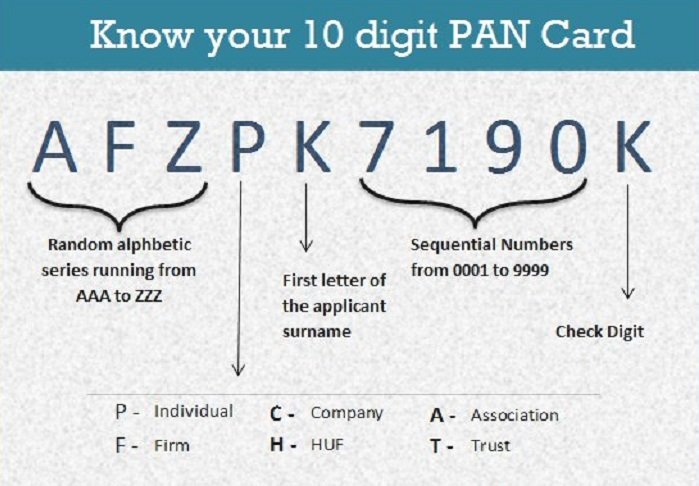

Structure of a PAN Number

A PAN number is composed of 10 characters in the following format: AAAAA9999A. Here’s what each section represents:

- First Five Characters: The first three characters are alphabetical, representing a sequence running from AAA to ZZZ. The fourth character signifies the type of PAN holder (e.g., ‘P’ for Individual, ‘C’ for Company, ‘H’ for HUF, etc.). The fifth character is the first letter of the PAN holder’s last name or entity name.

- Next Four Characters: These are numerical, ranging from 0001 to 9999.

- Last Character: This is an alphabetical check digit.

Why is PAN Important?

-

Taxation Purposes: PAN is mandatory for all financial transactions and is required to file income tax returns. It helps the Income Tax Department track and prevent tax evasion.

-

Financial Transactions: PAN is required for various financial activities, including opening a bank account, applying for a credit card, or purchasing assets like property or vehicles.

-

Proof of Identity: PAN serves as a valid proof of identity for various administrative purposes, both in governmental and private sectors.

How to Apply for a PAN Number?

Applying for a PAN number is a straightforward process that can be done online or offline:

-

Online Application: Visit the NSDL or UTIITSL website and fill out the PAN application form (Form 49A for individuals). After submitting the form and paying the required fee, you will need to submit your supporting documents. Once verified, your PAN card will be sent to your address.

-

Offline Application: You can apply by submitting Form 49A at any PAN service center along with the required documents and fee.

Required Documents for PAN Application

To apply for a PAN number, you'll need the following documents:

- Proof of Identity: Passport, Aadhaar card, Voter ID, etc.

- Proof of Address: Utility bill, property tax receipt, etc.

- Proof of Date of Birth: Birth certificate, passport, etc.

Frequently Asked Questions (FAQs)

1. Can I have more than one PAN?

No, having more than one PAN is illegal and can lead to a penalty.

2. What should I do if I lose my PAN card?

You can apply for a duplicate PAN card online or offline by providing your PAN number and proof of identity.

3. Can foreign nationals apply for a PAN?

Yes, foreign nationals and entities can apply for a PAN number if they are engaged in any business or financial activities in India.

4. How long does it take to get a PAN card?

Typically, it takes about 15-20 business days after submitting the application.

Conclusion

The PAN number is an indispensable tool for individuals and businesses alike, ensuring transparency and accountability in financial transactions. Understanding its importance and how to obtain one is essential for anyone engaging in financial activities in India. Make sure to keep your PAN details secure and up to date to avoid any issues in the future.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?